From: Outsider Club <ww-eletter@angelnexus.com>

Date: Fri, Jul 31, 2015 at 8:06 PM

Subject: You'll want to own this when...

To: pascal.alter@gmail.com

|

| Silver Prices Set to Rise 2,400%? The game is up for the Federal Reserve. Years of their easy money policies are about to explode in our faces. The value of the dollar will be destroyed, and a massive transfer of wealth will take place. Gold and silver will win out, as they always do. This research shows gold could go to $6,000... And silver could shoot to $500. If you want to be on the right side of history, you need to educate yourself right away. Claim your free precious metals investment package, including a FREE copy of the best-selling precious metals book of all time... You'll want to own this when... By Jason Simpkins | Friday, July 31st, 2015 Opening a gold mine is a costly endeavor. Simply finding a deposit, exploring potential reserves, navigating governmental bureaucracy and environmental red tape, and building the necessary facilities can have a project bogged down before it even gets to the point of extraction. But what if I told you there was a mine already built, permitted, and operational... That early indications suggested as much as 800,000 ounces of gold were present... And that the only thing left to do was to get to work? That's exactly the position in which Pershing Gold Corp. finds itself. The company is literally sitting on a gold mine, poised to take the final leap into full-fledged production in a matter of months. And if gold prices stabilize, it could be extremely profitable. Here's the story... History Pershing operates the Relief Canyon mine in Northwest Nevada. Located in Pershing County, along the western edge of the Humboldt Range, the Relief Canyon Mine is situated 110 miles northeast of Reno. Miners there have been producing gold, silver, and mercury since the 1860s, with gold first discovered in 1979. In 1986, Pegasus Gold Corp. bought a four-year option on the mining property, producing more than 100,000 ounces of gold from November 1986 to September 1990. In 1995, Firstgold Corp. took the mine over from Pegasus. And from 1996 to 2008, the company drilled 182 holes and revamped the Adsorption-Desorption Recovery (ADR) plant originally built by Pegasus in the late 80s. Advertisement What if you could buy Apple again for just $1 per share? No options, futures, or risky investment required. Hard to believe? It's happened several times before when Apple has "gone on sale" for $1. And now I've identified exactly when it could happen again, making a small group of investors rich. It's not just Apple, either... Dozens of little-know blue chip stocks will go on sale for $10 or less. This is a REAL opportunity to pocket 1,000% gains or more on the world's safest companies. But you need to move now, before September 16, if you want to lock in this deal of a lifetime. However, Firstgold Corp. was financially backed by Chinese investors. And in 2009, the Committee on Foreign Investment ruled that the mine was too close to Fallon's Naval Air Station to allow a foreign presence. Firstgold wasn't able to come up with a solid plan to reorganize its operations, and it was subsequently forced into bankruptcy court. Thus, control of Relief Canyon mine fell to the company's creditors, who sold it to Pershing in 2011. (This is key because Pershing basically inherited Firstgold's newly-built ADR plant.) Since then, Pershing has been hard at work, snapping up acreage in the surrounding area, updating infrastructure, and pursuing the necessary permits to revive Relief Canyon. From 2012 to 2015, Pershing expanded the project's size from 1,100 acres to 25,000 acres.

It's also found a substantial amount of gold... Findings As the area's history supports, the Relief Canyon Mine holds much potential. After all, the mine had previously yielded impressive results despite the area being largely unexplored. But even Pershing has been pleasantly surprised by its findings. The company's most recent drilling results showed a measured and indicated resource of 739,000 ounces of gold. That's 34% higher than the 552,000 ounces of measured and indicated resource estimated in March 2014. And on top of that, the 2015 results — which included 141 core holes and approximately 80,000 feet of drilling — showed an inferred resource of another 70,000 ounces.

Much of that gold has been of a quality grade, as well. Among the results of this drilling program are multiple core-holes with high-grade intercepts. Holes RC15-264, RC15-265A, and RC15-279 included gold intercepts of 76.8 grams per ton (gpt), 87.9 gpt, and 123.9 gpt, respectively. These, and many other intercepts encountered in the recent drilling program, grade significantly higher than Relief Canyon's historic average of approximately 1 gpt. And since it's acquired so much of the surrounding property, there are ample targets for new exploration.

High-grade intercepts are not definitive proof of prevalent reserves, but they're a crucial early indicator of success. Equally important, with so much infrastructure left over from previous mining activity, production and development costs have been largely contained. Advertisement Obama's "Secret Pipeline" Believe it or not, this is the reason Obama vetoed the Keystone XL pipeline... and authorized the construction of a "secret pipeline"... A pipeline that's central to his economic policy, foreign policy, and environmental agenda. One that comes with a $3.4 trillion global price tag. Click here to see why he's supporting this secret pipeline... and why it could also be one of the most lucrative investments this year. Operations The Relief Canyon Mine property includes three open-pit mines (North Pit, South Pit, Light Bulb), as well as a state-of-the-art, fully permitted and constructed heap leach processing facility. This processing facility was designed and built specifically for the ore at Relief Canyon. If you're not familiar, heap leaching means ore is crushed into fine particles, "heaped" into large piles, and doused with cyanide. The cyanide trickles through the ore, bonding with any gold along the way. The resulting gold-cyanide solution is then collected, and the gold separated back out. Again, Pershing's heap-leach processing facility is already built and fully permitted. It has the capacity to process gold-bearing solutions from the leaching of 8 million tons of ore per year. The leach pad can hold 21 million tons and can be readily expanded. The plant is ideally situated to process ore from future discoveries of satellite deposits.

As you can see in the photo above, everything is nicely contained and perfectly accessible. So to recap...

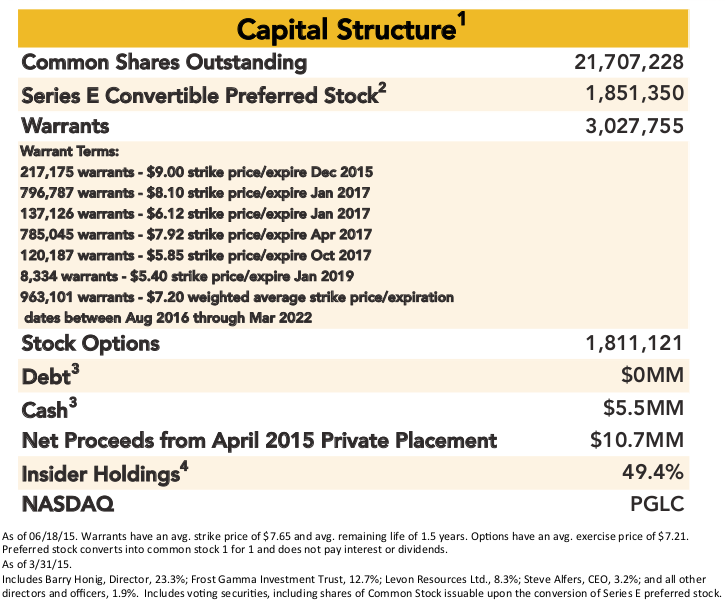

The only thing left to do is start production. That, the company says, will likely happen in mid-2016, pending a review of the project's economic viability later this year. According to CEO Steve Alfers, that economic report will show production costs of between $600 and $800 per ounce. Alfers also says production will average 84,000 ounces per year over the mine's lifespan. Valuation Pershing Gold has a recent stock price of $5.00 per share. That's in the lower end of its 52-week range of $3.60 to $7.45. At that valuation, the company's market cap is roughly $120 million. That's slightly below the company's net asset value, which we can estimate to be somewhere between $170 million and $200 million based on current gold prices. Pershing has no debt and roughly $13 million of cash on hand, having recently completed an $11.5 million raise. The final cost of opening the mine and going into production is extremely low. We won't know the specifics until the economic study is completed, but it's believed to be about $25 million (an estimated $13 million CAPEX and $12 million sustaining costs).

Basically, the company needs to raise another $15 million to move forward — if that is what it intends to do. That is, there is a chance that the mine's opening could be delayed. Gold prices have been trending steadily downward over the past few years, and it's unclear when, or to what degree, they might rebound. To conduct its economic study, Pershing originally estimated gold prices at $1,200 to $1,250 per ounce. However, gold prices recently fell to about $1,080 per ounce, so the company will have to adjust its estimate. Even at current price levels, the mine will still be profitable. But if gold prices continue to fall, it might not be prudent to start production. The company might be better off burning through some of its cash (and possibly raising more) as it waits for prices to rebound. Another uncertainty is the potential of a buyout or merger. If the project stalls, it could get picked up by a larger mining company looking to add a shovel-ready project to its asset sheet. The fact that Pershing has no debt makes it particularly attractive in that capacity. Alfers said his company had considered potential mergers in the past, but there are no such plans now. For the time being, Pershing's strategy is to unlock shareholder value by advancing the Relief Canyon Mine to commercial production, expanding the mine through development drilling, and exploring its 25,000 acres of land for more gold deposits. It's all there for the taking. The company just needs a bit more cooperation from gold prices. As far as the management team is concerned, CEO Alfers has 30 years of experience in the mining industry, formerly serving as the CEO of New West Gold and the chief of U.S. operations for mining royalty company Franco Nevada. He's joined by Chief Operating Officer Timothy Janke, who worked as general manager at the Marigold, Florida Canyon, Ruby Hill, and Pinson mines in Nevada. Senior Vice President Debra Struhsacker also has a proven track record of successfully permitting mineral exploration and mining projects. She played key roles in the fast-track permitting of Franco-Nevada's Ken Snyder Mine (now Newmont's Midas Mine), and in exploring and developing the Long Canyon Project (also now Newmont's), both in Elko County, Nevada. Advertisement Saddam's Lost Oil Thanks to an epic fleecing in the oil community, you have the rare chance to get in on a cache of crude that no one (even Saddam Hussein) knew existed. There are 13.7 billion barrels of oil just underneath the surface in the last place you probably ever expected... and one small company is already pumping it out of the ground. Click here to see why this opportunity could be even better than the last one. Conclusion Pershing is an early-stage miner with huge benefits. One is that it's avoided many of the costs associated with starting up from scratch. ADP plants and processing facilities like those present at Relief Canyon can cost hundreds of millions of dollars. Pershing acquired them, unused, in a bankruptcy sale. Another is that it's operating in a historically-proven region. Pegasus had some early success in the 1980s, and technology has come a long way since then — both in terms of finding and extracting gold deposits. And much of the area has yet to be fully explored. Early indications already suggest that a significant amount of gold is present and that it's of a higher quality than previously thought. The stock could easily move higher on the release of its financial estimate later this year. However, the real momentum events would be starting production, or even the announcement of a concrete start date. Nothing is guaranteed. The price of gold remains the company's most formidable adversary. But if the price of gold stabilizes or moves higher, Pershing will stand to benefit. If you're interested in more ways to play gold and silver, you can get a free copy of the Guide to Investing in Gold & Silver by clicking here. Written by Michael Maloney, one of the most respected authorities on gold and silver investing in the world, the Guide to Investing in Gold & Silver is the top-selling precious metals investment book of all time. Maloney is one of the few who accurately predicted the housing crash, the amazing rise in precious metals, and the current deflation. Now he thinks gold and silver prices are not just bottoming, but poised to rise exponentially. Click here to get your free copy. Get paid,

Jason Simpkins Jason Simpkins is a seven-year veteran of the financial publishing industry, where he's served as a reporter, analyst, investment strategist and prognosticator. He's written more than 1,000 articles pertaining to personal finance and macroeconomics. Simpkins also served as the chief investment analyst for a trading service that focused exclusively on high-flying energy stocks. For more on Jason, check out his editor's page. |

This email was sent to pascal.alter@gmail.com . You can manage your subscription and get our privacy policy here. Outsider Club, Copyright © 2015, Outsider Club LLC, 111 Market Place #720, Baltimore, MD 21202. No statement or expression of opinion, or any other matter herein, directly or indirectly, is an offer or the solicitation of an offer to buy or sell the securities or financial instruments mentioned. While we believe the sources of information to be reliable, we in no way represent or guarantee the accuracy of the statements made herein. The Outsider Club does not provide individual investment counseling, act as an investment advisor, or individually advocate the purchase or sale of any security or investment. Neither the publisher nor the editors are registered investment advisors. Subscribers should not view this publication as offering personalized legal or investment counseling. Investments recommended in this publication should be made only after consulting with your investment advisor and only after reviewing the prospectus or financial statements of the company in question. Unauthorized reproduction of this newsletter or its contents by Xerography, facsimile, or any other means is illegal and punishable by law. Please note: It is not our intention to send email to anyone who doesn't want it.(....) |

Brak komentarzy:

Prześlij komentarz