From: Outsider Club <ww-eletter@angelnexus.com>

Date: Thu, Jan 15, 2015 at 10:05 PM

Subject: Putin Strikes Again! Cutting Off Gas Supply & Selling Dollars

To: pascal.alter@gmail.com

Having trouble viewing this issue? Click here. |

| Have You Heard of "Blue Light" Technology? It's a groundbreaking cancer screen system that could not only save your life but also make you a millionaire for as little as $5,000. In short, it's a simple device that makes cancer visible to the naked eye. (You can see it in action here.) That's why it's revolutionizing the cancer diagnostics industry. And one tiny company holds the patent to this technology. Click here to get the ticker symbol. This could be the most lucrative investment you will ever make. Putin Strikes Again! Cutting Off Gas Supply & Selling Dollars By Brittany Stepniak | Thursday, January 15th, 2015 The warning shots keep on firing over in Russia... The ruble plunged to a month low as continued depression in oil prices added further fuel to the already burning economic fire. Russia's worsening currency crisis could spur a global financial crisis as it spills over into emerging markets and threatens our own recovery at home in the U.S. Meanwhile, Putin hasn't been helping the situation. Instead of opening dialogue that could help ease harmful economic sanctions, he's boosted combat as part of a plan to gain control of the Arctic, the annexed Crimean Peninsula, and Kaliningrad — the westernmost territory. All three regions could pose serious threats when it comes to potential rivalry with the U.S. and NATO. Especially when you consider that Putin recently singed a new military document, re-emphasizing sentiments that NATO "threatens Russian security"... As evidenced by Russia's willingness to engage in deadly violence in Ukraine in order to secure control of Crimea, I'm not optimistic about the endgame results in regards to what Putin is willing to do in order to secure Kaliningrad — sandwiched right in between EU and NATO members Poland and Lithuania. Advertisement Biggest "blockbuster" discovery since penicillin 72 years ago, the invention of penicillin changed the world... It changed the way we get sick... increased human life expectancy... and even won World War II. And it changed investors' fortunes like nothing on record with earth-shattering gains like 1,640,000%. Right now, I'm excited to inform you that history is repeating itself. A new breakthrough drug — as revolutionary as penicillin — is hitting the market. And it could once again spark the greatest profit run in history. Putin Update: New Friends, New Projects But Putin seems to have secured at least one ally: Indian Prime Minister Narendra Modi. The two met mid-December to procure a stronger relationship; both militarily and within the energy sector. Russia's state-owned Rosneft signed a preliminary agreement to supply India with 10 million tons of oil over the next 10 years. Putin even invited India for assistance with the "Russian-Arctic" shelf. Allegedly, Rosneft discovered (back in September) enough oil in the Arctic to put it on par with the resource base of Saudi Arabia. The one massive hiccup in Putin's master plan to dominate the energy market is the fact that he needs Exxon's expertise in order to drill in the frigid offshore Arctic conditions. But sanctions, as they stand currently, prohibit Exxon from drilling there. Don't be mistaken, the losses on Exxon's side of things are critical as well. Russia is the company's largest exploration area. And unless Putin articulates a more flexible willingness for dialogue with the West, his plans are going to remain lofty but futile. Meanwhile, German Gref — chairman and president of one of Russia's largest state-owned banks — has warned of the economic consequences of this political standoff. According to Interfax, Sberbank's President Gref said, "We will have one big state; our entire economy will be under the control of the state," Lenders' property would become the banks', the state would capitalize banks, and then "the banks would purchase enterprises, turning into 'finance industry' groups," Gref declared. Advertisement Facebook "Internet Royalties" are now available You might not realize this, but EVERY time someone logs into Facebook (or starts a new account), you could actually be collecting a small sum of cash. You don't have to own Facebook stock, have your own account, or ever visit the site. All you have to do is take advantage of a little-known strategy that allows you to collect "royalties" from some of the biggest names on the Internet. Your first payout check could be for $48k if you follow the instructions in this FREE video. Gref's Grim Outlook If this scenario unfolds while oil prices remain so low, the banking crisis at large would be "enormous", according to Gref. His grim predictions aren't really novel though. Just a few weeks ago another banker cited the emerging catastrophe as nothing shy of "the end of the banking system." That's a pretty egregious statement, but certainly not completely misguided. Indeed, many experts argue that the great global recession is deepening as we speak. And if Putin remains egocentrically focused on strengthening military capabilities without more directly addressing and remedying the glaring economic woes at stake, things could get even uglier... Bloomberg reports:

It should come as no surprise, then, that investors are dumping Russian stocks and Russia's largest lenders are slipping too. As the falling ruble continues to decrease the solvency of borrowers — simultaneously reducing the number of potential borrowers — the Russian banking system is facing great risk, according to Oleg Popov, money manager at Allianz Investments in Moscow. Consequently, this "leads to the shrinking of the banking sector over all," he said. Advertisement Gold for $35/Ounce? It sounds crazy, I know, but this is what happens when the Chinese decide to throw the entire gold market out of kilter by going on a $3.4 trillion buying spree. They're trying to horde more gold than anybody in history, but in the process, they've opened up an opportunity that allows everyday citizens to purchase gold at over 97% off spot price. The potential profits are as insane as the story behind it all. Put this to work for YOU by clicking here. Putin's Bag of Tricks But Putin hasn't thrown in the towel quite yet. Russia announced yesterday that it "will unseal its $88 billion Reserve Fund and use it to acquire rubles, the government's latest effort to stem the country's worst currency crisis in almost 17 years and limit its effects on the ailing economy." So instead of using this money to recycle back into U.S. denominated assets, Russia's purchasing more rubles. But as I mentioned in a previous related article, all is fair in love and war. And it appears as though Russia will stop at nothing to make the rest of the world pay (from an energy and a financial perspective) for recent Western sanctions. Although the ruble was the world's second-worst performing currency last year, and has continued weakening for four consecutive days this week, some economists believe that yesterday's announcement "looks ruble supportive." Either way, Russia's stirring up trouble. Whether it's a Russian default or not, we should all be worried. If Russia's current financial plan does happen to succeed, Putin's not going to blithely stop there... Just a few months ago Kremlin economic aide Serge Glazyev warned:

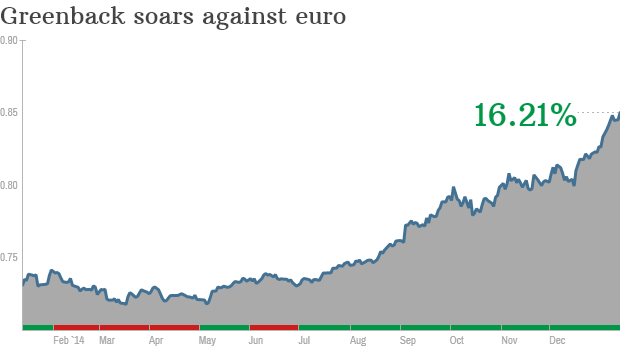

A complete crash might be hyperbole, but the big picture message should wave some red flags for financial leaders here in the U.S. If you read my article about China's ploy to overthrow the U.S. dollar by manipulating the IMF and stockpiling gold, you understand the global dilemma here. China has $1.32 trillion in U.S. Treasuries. If both Russia and China start dumping Treasury bonds (in favor or gold, rubles, or otherwise), it certainly could hurt us... the situation seems especially disconcerting now that Russia's acquired India as an ally (one of the world's top gold consumers, second only to China now). Nonetheless, there's no denying that the dollar is looking pretty superior right now, especially against the euro. It's soared 16.21% since this time last year!

But don't let that blind you from the fact that our financial system is in jeopardy, and our opponents are playing smart. Just make sure you're paying attention to the ongoing global chess game right now. Every move counts, and Russia, Europe, China, and India are all playing pivotal roles. It certainly won't hurt to hedge your bets and diversify accordingly... Farewell for now,

Brittany Stepniak Brittany Stepniak is the Project Manager and Editor for the Outsider Club. Her "big picture" insights have helped guide thousands of investors towards achieving and maintaining personal and financial liberties while pursuing their individual dreams in lieu of all the modern-day chaos. For more on Brittany, take a look at her editor's page. |

This email was sent to pascal.alter@gmail.com .(....) Outsider Club, Copyright © 2015, Outsider Club LLC, 111 Market Place #720, Baltimore, MD 21202. No statement or expression of opinion, or any other matter herein, directly or indirectly, is an offer or the solicitation of an offer to buy or sell the securities or financial instruments mentioned. While we believe the sources of information to be reliable, we in no way represent or guarantee the accuracy of the statements made herein. The Outsider Club does not provide individual investment counseling, act as an investment advisor, or individually advocate the purchase or sale of any security or investment. Neither the publisher nor the editors are registered investment advisors. Subscribers should not view this publication as offering personalized legal or investment counseling. Investments recommended in this publication should be made only after consulting with your investment advisor and only after reviewing the prospectus or financial statements of the company in question. Unauthorized reproduction of this newsletter or its contents by Xerography, facsimile, or any other means is illegal and punishable by law. Please note: It is not our intention to send email to anyone who doesn't want it. If you're not sure why you're getting this e-letter, or no longer wish to receive it, get more info here, including our privacy policy and information on how to manage your subscription. |

@AngelPubGirl on Twitter

@AngelPubGirl on Twitter

Brak komentarzy:

Prześlij komentarz